The 4 Stages of Startup Development: A Simple Guide and Free PPT Template

Download the 4 Stages of Startup Development in PPT using a computer:

Introduction

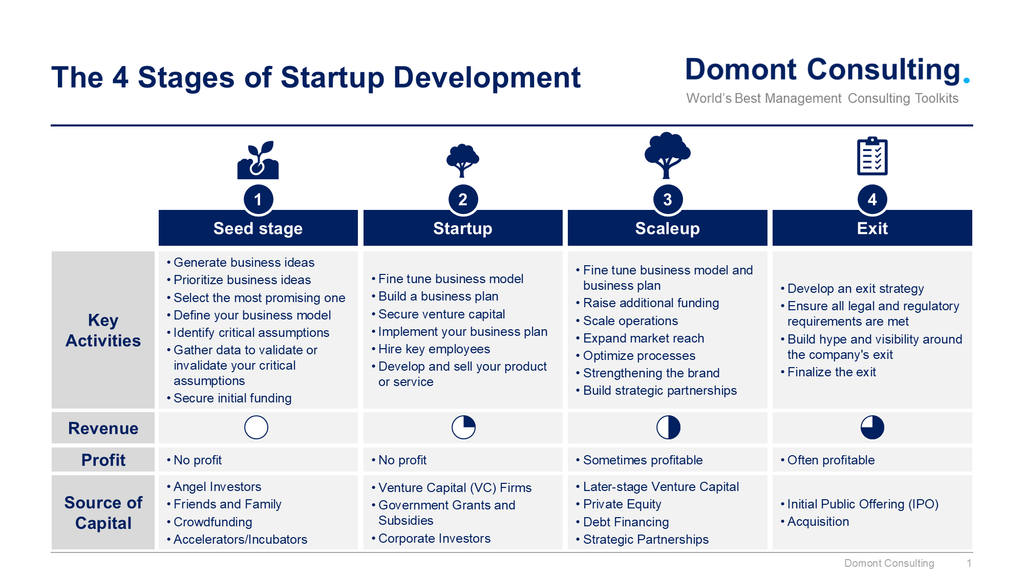

The journey of transforming an innovative idea into a successful business involves navigating through several critical stages. Each stage comes with its unique set of challenges, activities, and milestones that guide entrepreneurs from the initial concept to a potential exit. In the following sections, we will explore the four key stages of startup development: Seed Stage, Startup, Scaleup, and Exit. Understanding these stages will provide a roadmap for entrepreneurs seeking to build and grow a sustainable and thriving business.

Seed Stage

In the seed stage, entrepreneurs generate business ideas, prioritize them, and select the most promising one. They define their business model, identify critical assumptions, and gather data to validate or invalidate those assumptions. During this stage, there is no revenue or profit, and initial funding typically comes from angel investors, friends and family, crowdfunding, or accelerators and incubators.

Startup Stage

During the startup stage, the business model is fine-tuned, and a comprehensive business plan is built. Entrepreneurs secure venture capital, implement their business plan, hire key employees, and develop and sell their product or service. At this point, the company start to generate a small revenue but is usually not profitable. Capital sources include venture capital firms, government grants and subsidies, and corporate investors.

Scaleup Stage

In the scaleup stage, the business model and business plan are further refined. Additional funding is raised, and operations are scaled up. The company expands its market reach, optimizes processes, strengthens its brand, and builds strategic partnerships. At this stage, the revenue is growing and the company might sometimes be profitable. The sources of capital during this stage include later-stage venture capital, private equity, debt financing, and strategic partnerships.

Exit Stage

Finally, in the exit stage, the company develops an exit strategy, ensures all legal and regulatory requirements are met, and builds hype and visibility around its exit. At this stage, the revenue keeps growing and the company is usually profitable or at least has defined a clear path to profitability. Common sources of capital for an exit include initial public offerings (IPOs) and acquisitions.

Need more help? Check our Toolkits:

- Corporate/Business Strategy and Strategic Planning Toolkit

- Financial Modeling, Planning & Analysis Toolkit