Invaluable resource for my consulting firm

With all these toolkits, Domont Consulting provided an invaluable resource for me and my Consulting Firm. It would have taken us more than a year to create the same Toolkits on our own!

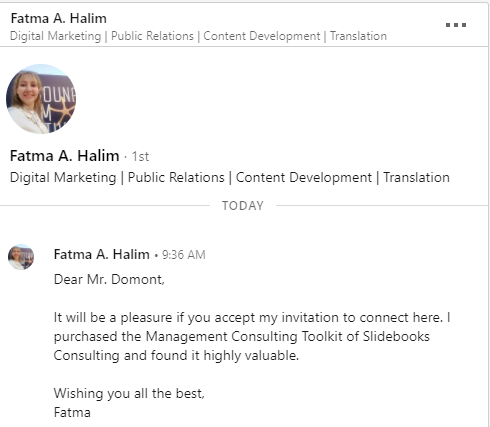

To instantly translate our Toolkits, our clients usually choose the world’s best AI translators in the world: Deepl Translator or Microsoft Translator.

To instantly translate our Toolkits, our clients usually choose the world’s best AI translators in the world: Deepl Translator or Microsoft Translator.

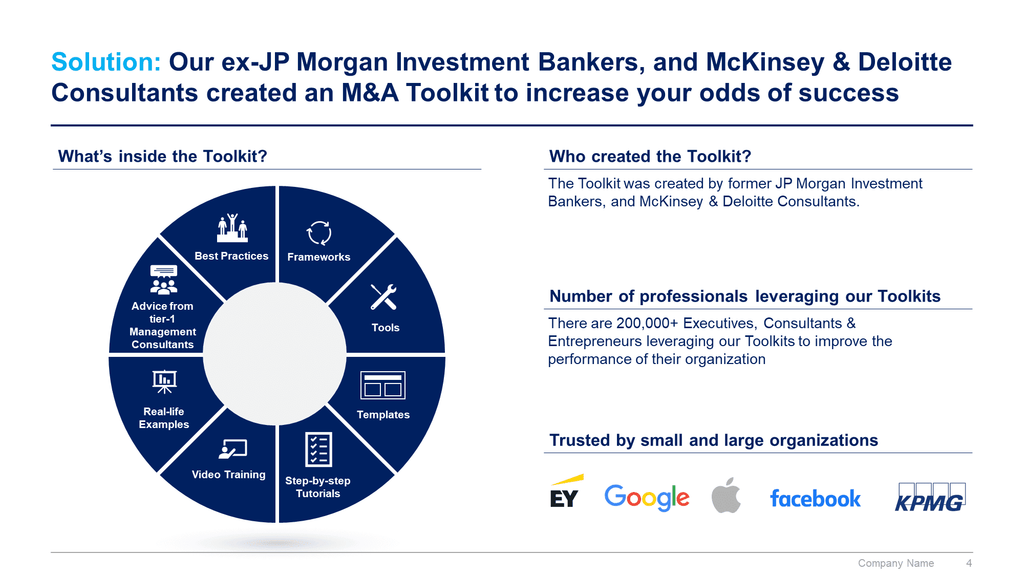

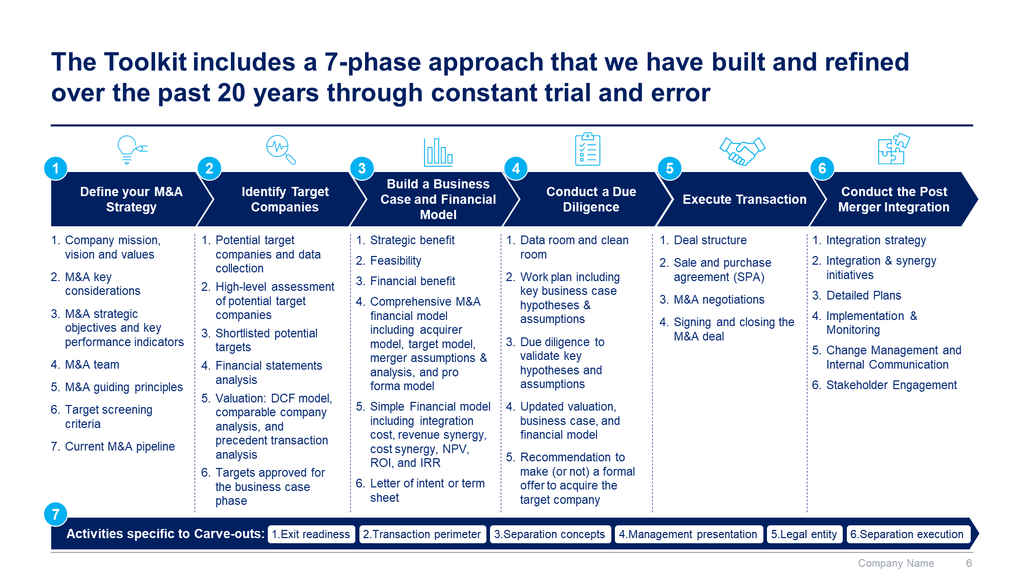

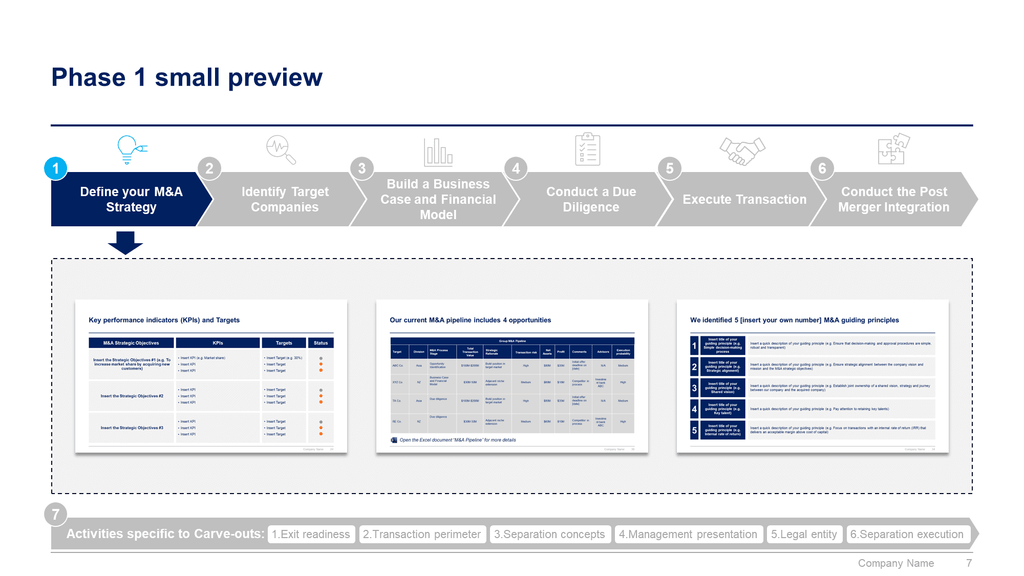

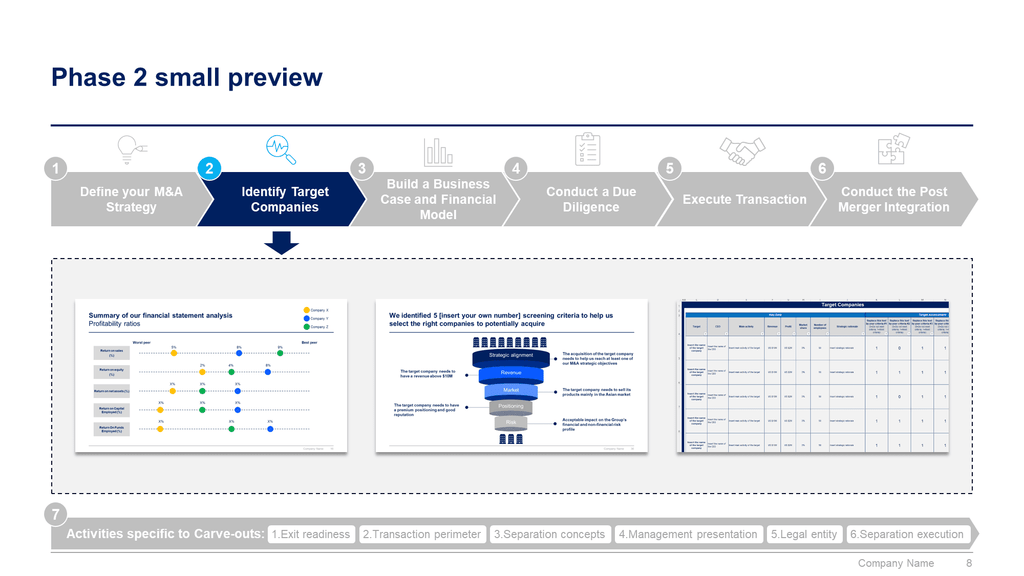

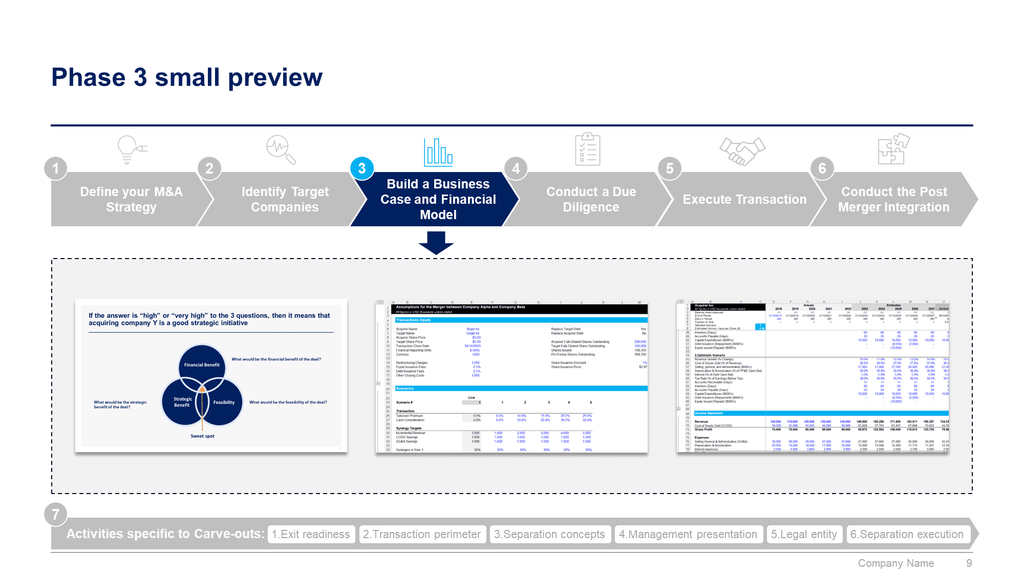

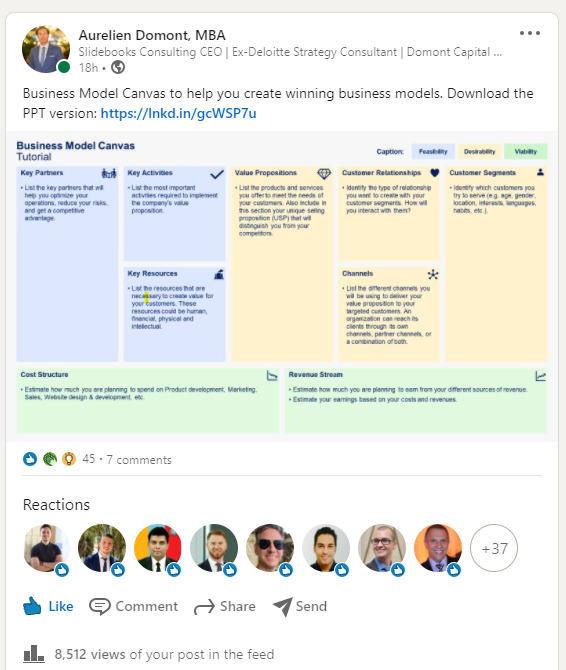

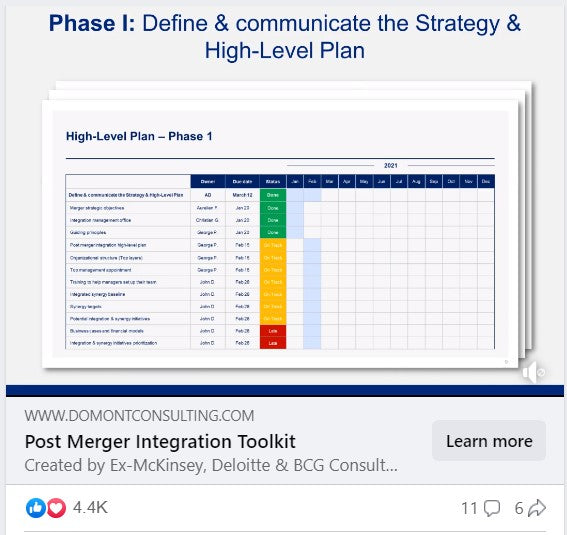

This M&A Toolkit was created by former JP Morgan Investment Bankers, and McKinsey & Deloitte Consultants, after more than 4,000 hours of work. It is considered the world's best & most comprehensive Mergers and Acquisitions Toolkit. It includes all the Frameworks, Best Practices & Templates required to improve the M&A capability of your organization and boost your personal career.

Objectives

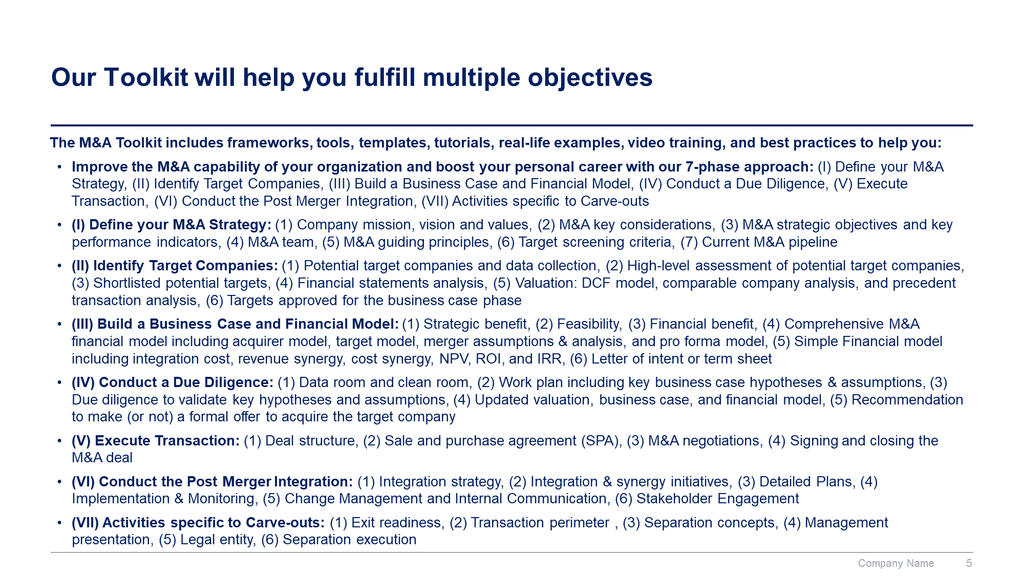

This Toolkit includes frameworks, tools, templates, tutorials, real-life examples, best practices, and video training to help you:

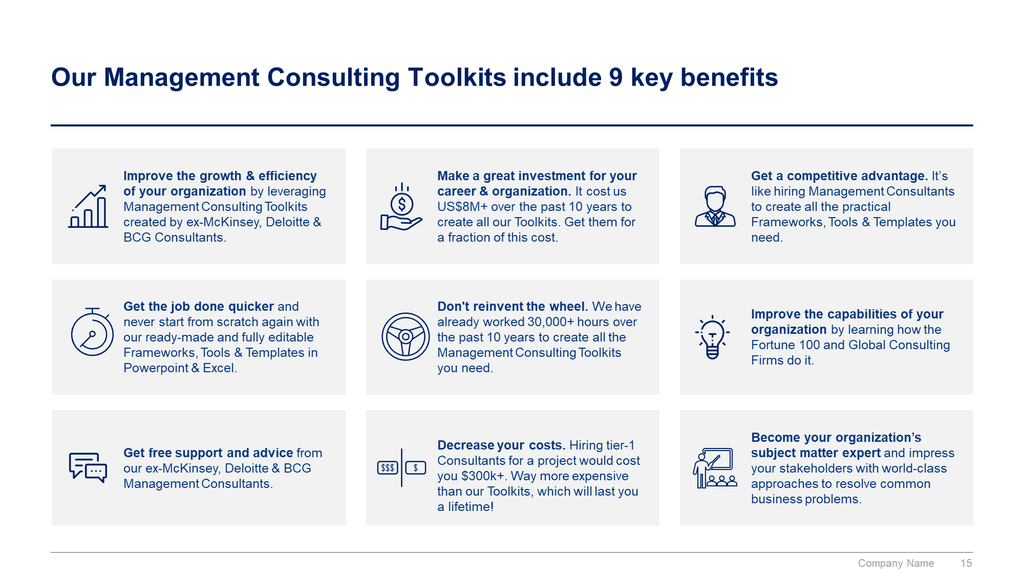

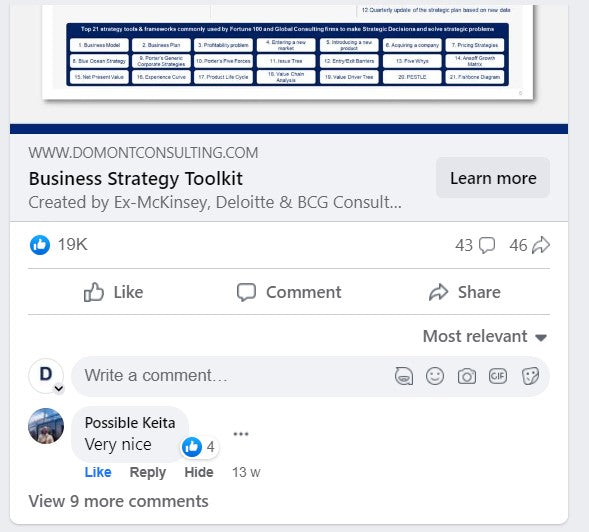

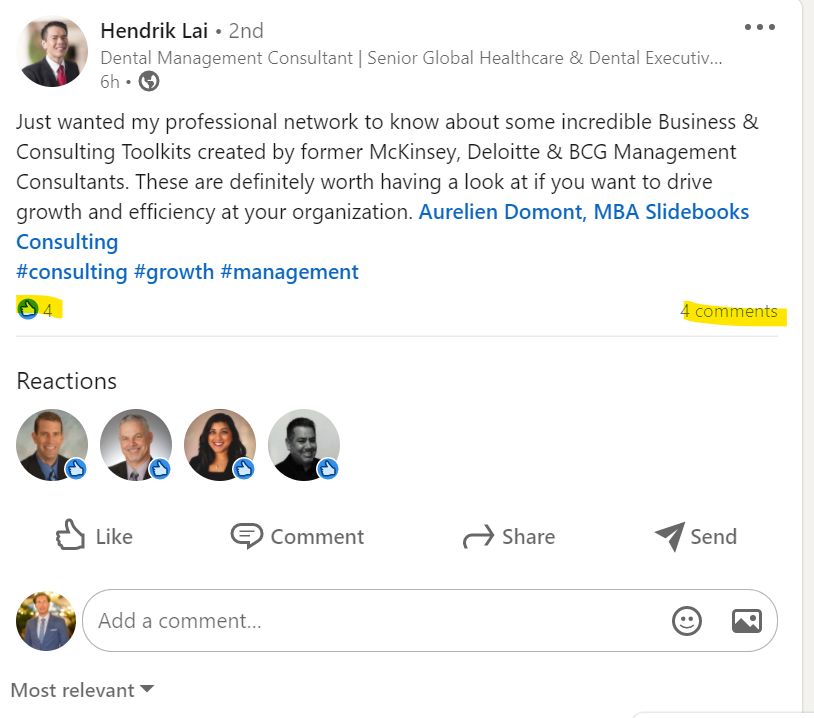

Improve the growth & efficiency of your organization by leveraging Management Consulting Toolkits created by ex-McKinsey, Deloitte & BCG Consultants.

Make a great investment for your career & organization. It cost us US$8M+ over the past 10 years to create all our Toolkits. Get them for a fraction of this cost.

Get a competitive advantage. It’s like hiring Management Consultants to create all the practical Frameworks, Tools & Templates you need.

Get the job done quicker and never start from scratch again with our ready-made and fully editable Frameworks, Tools & Templates in Powerpoint & Excel.

Don't reinvent the wheel. We have already worked 30,000+ hours over the past 10 years to create all the Management Consulting Toolkits you need.

Improve the capabilities of your organization by learning how the Fortune 100 and Global Consulting Firms do it.

Get free support and advice from our ex-McKinsey, Deloitte & BCG Management Consultants.

Decrease your costs. Hiring tier-1 Consultants for a project would cost you $300k+. Way more expensive than our Toolkits, which will last you a lifetime!

Become your organization’s subject matter expert and impress your stakeholders with world-class approaches to resolve common business problems.

Our Story

"Imagine having a team of ex-McKinsey, Deloitte and BCG Management Consultants at your disposal 24/7 to help you solve your business problems and improve the growth and efficiency of your organization. How much more confident would you be about the future performance of your organization and your own career progression? How much time could you save?

If you have ever tried solving business problems that you haven’t encountered before, you know how frustrating it can be to start from scratch. And even then, you still aren’t sure if what you’re doing is going to end up wasting your time and money. Having someone by your side who has already solved these business problems would be a huge help. That’s why businesses hire management consultants for support in the first place.

The only problem is that hiring a couple of tier-1 Consultants for a project can cost upwards of $300,000, a price many businesses simply can’t afford.

I wanted to do something about this because I believe everyone deserves high-value business guidance, regardless of their budget!

That’s why in 2012, I teamed up with other ex-McKinsey, Deloitte and BCG Consultants to create comprehensive Management Consulting Toolkits designed to solve your business problems and improve the growth and efficiency of your organization!

Whether you're an executive, entrepreneur or consultant from a small or large organization, you can now leverage the know-how and best practices of our ex-McKinsey, Deloitte & BCG Management Consultants without breaking your budget.

And for those with a higher budget seeking additional support on top of our Toolkits, our tier-1 management consultants (ex-McKinsey, Deloitte, BCG) are available for hire all around the world. You will find our daily rates to be significantly more affordable than traditional tier-1 consulting firms, thanks to our innovative business model with minimal overhead.

After humble beginnings, we are now proud to have supported over 200,000 executives, consultants, and entrepreneurs from small and large organizations, in more than 180 countries."

With all these toolkits, Domont Consulting provided an invaluable resource for me and my Consulting Firm. It would have taken us more than a year to create the same Toolkits on our own!

I just downloaded a toolkit - it looks really handy and will start using it for my clients.

Business student

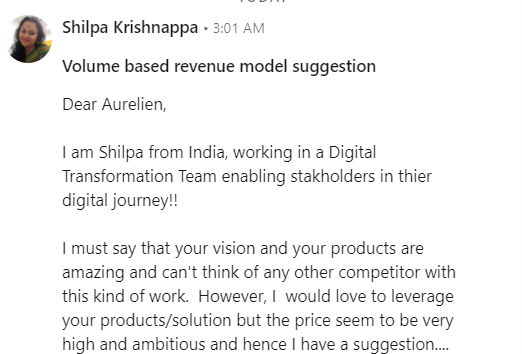

All these materials seem great but I'm a business student located in India and can't afford it. They should have different prices for students from developing countries.

Your Toolkits are terrific. Really. A great work. I loved them. It has given to me a lot of new ideas, refresh others.

Your toolkits and templates are truly world-class. I will be buying more toolkits in the next few months (as soon as business starts picking up in the ANZ region).

Senior Manager

Our profit increased by 27% in one year. Not all of this increase can be attributed to their toolkits, but a big part of it can. Everyone is now clear on where the company is going, and how to get there. And our project prioritization process is now way more robust, which led to better and quicker decisions.

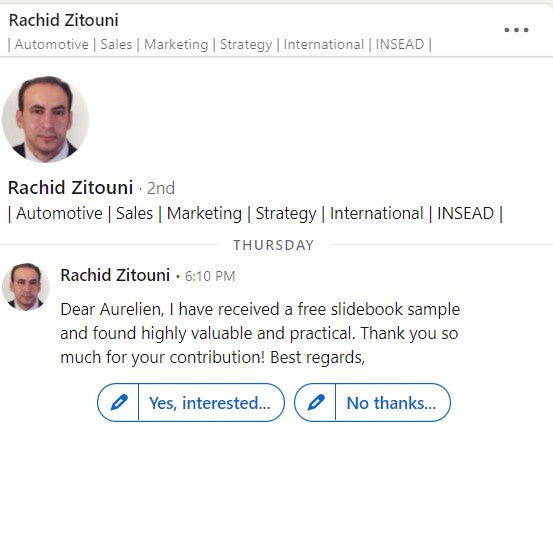

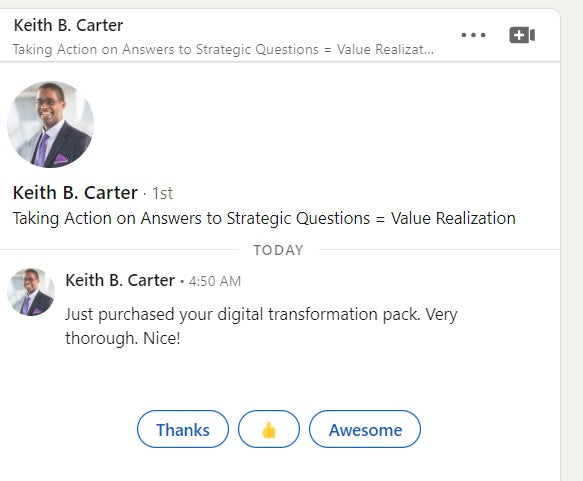

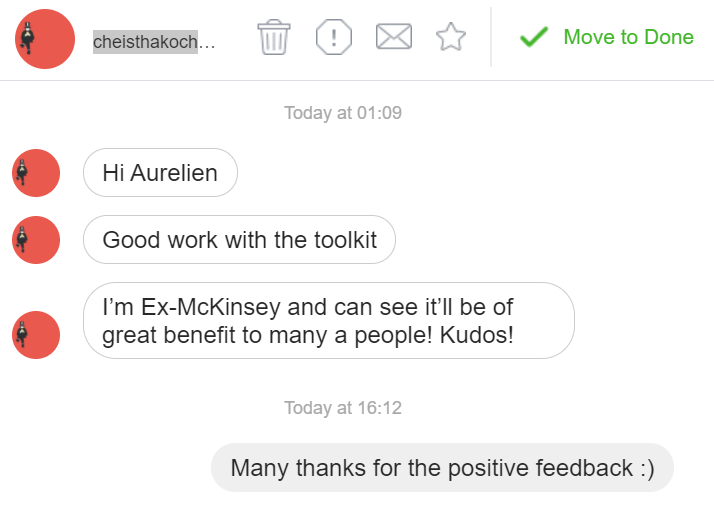

Great connecting with you Aurelien. You are an authority in business strategy. Went through your website and I saw so many amazing tools kits and templates. Great job you did there, I must confess.

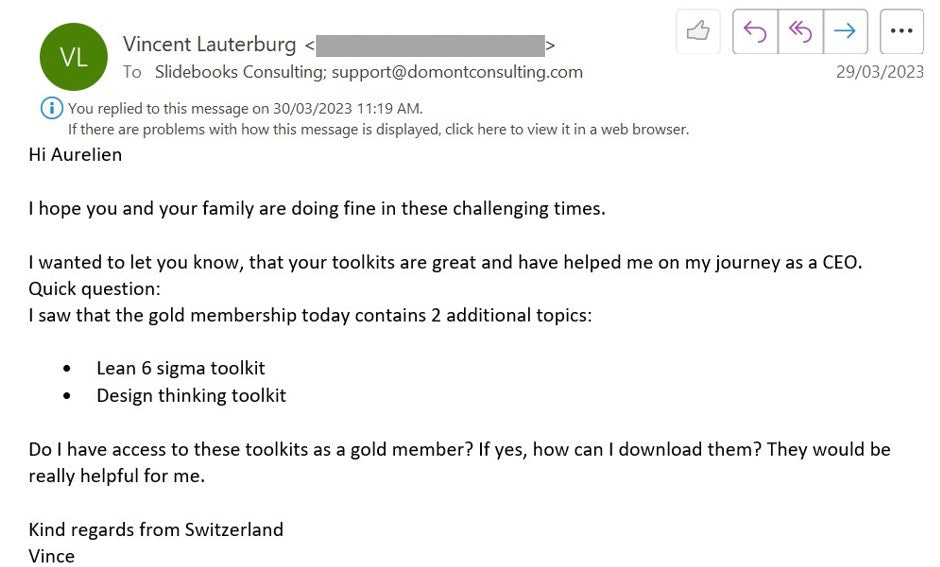

I have referred some of your toolkits, tremendous effort, great compilations!

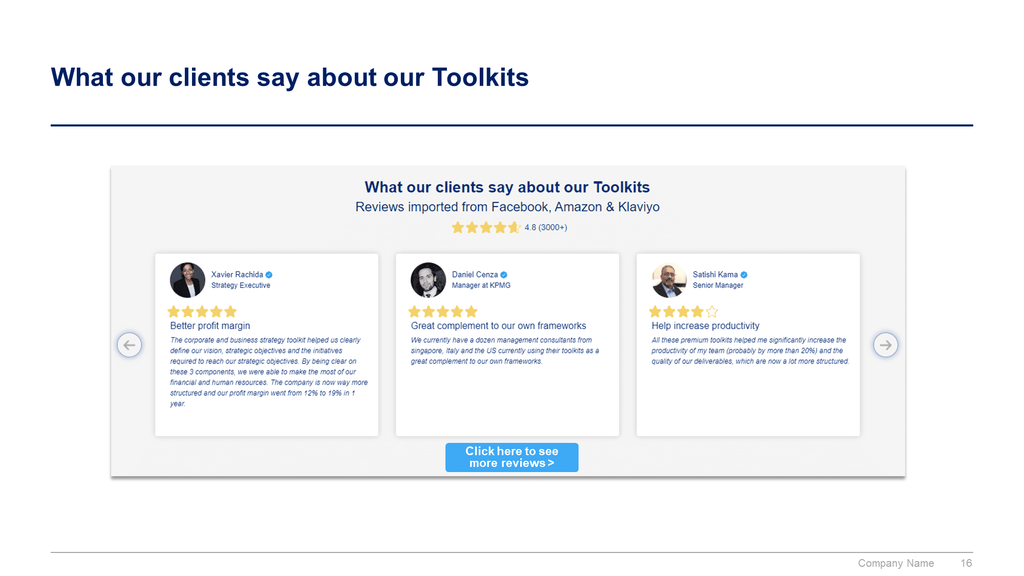

Strategy Executive

The corporate and business strategy toolkit helped us clearly define our vision, strategic objectives and the initiatives required to reach our strategic objectives. By being clear on these 3 components, we were able to make the most of our financial and human resources. The company is now way more structured and our profit margin went from 12% to 19% in 1 year.

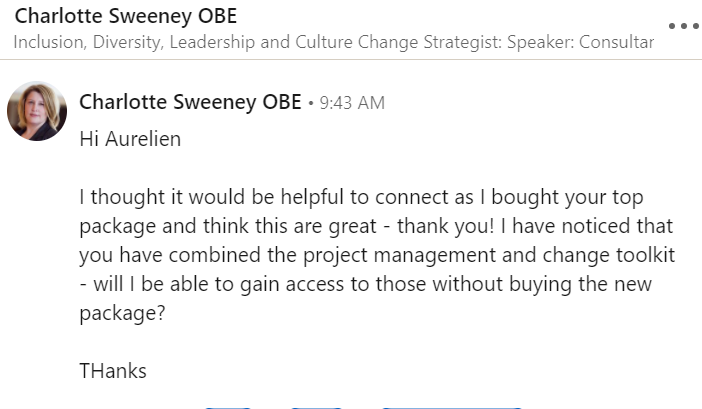

Their toolkits and slides are great and very useful for my company Change Works, which helps leaders and teams upskill for the future.

Manager at KPMG

We currently have a dozen management consultants from singapore, Italy and the US currently using their toolkits as a great complement to our own frameworks.

Senior Manager

All these premium toolkits helped me significantly increase the productivity of my team (probably by more than 20%) and the quality of our deliverables, which are now a lot more structured.

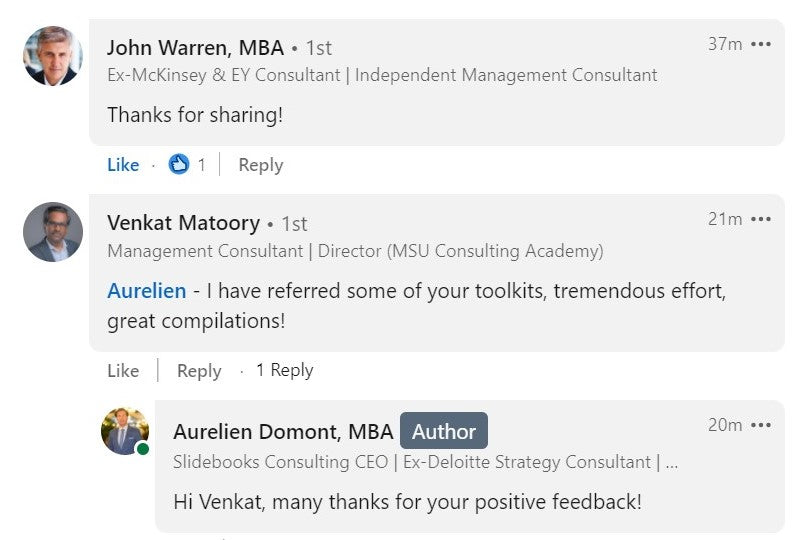

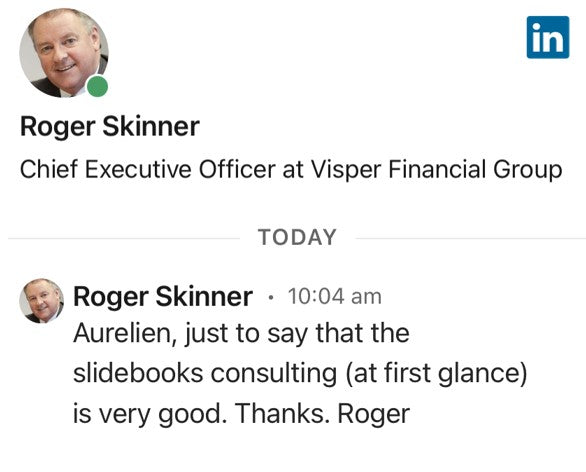

Your Toolkits are, at first glance, very good. Thanks. Roger

Independent Management Consultant

My motto is simple: why would I start from scratch when I can leverage someone else's work? Thank you for putting together so many frameworks & templates that I can reuse for my client engagements!

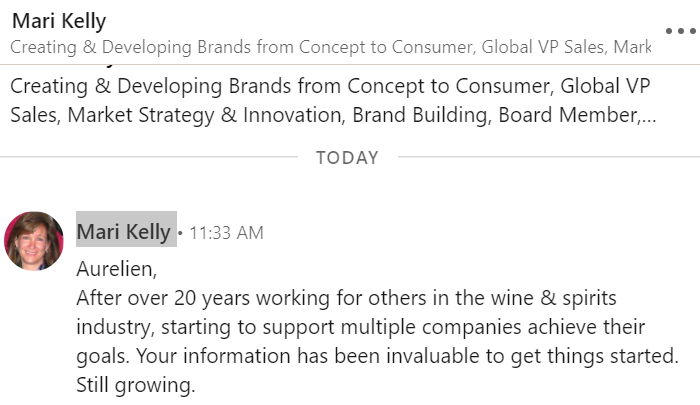

After over 20 years working for others in the wine & spirits industry, starting to support multiple companies achieve their goals. Your information has been invaluable to get things started. Thank you.

Strategy Consultant

Now that we have access to all these frameworks, Tools & Templates, we don’t have to spend as much in management consulting fees, which resulted in $750K+ of savings.

Manager for a Fortune 500 Company

Each time I face a new Business problem, I always go on Domont to see if one of their tier one Consultants already created a structured approach to solve it.

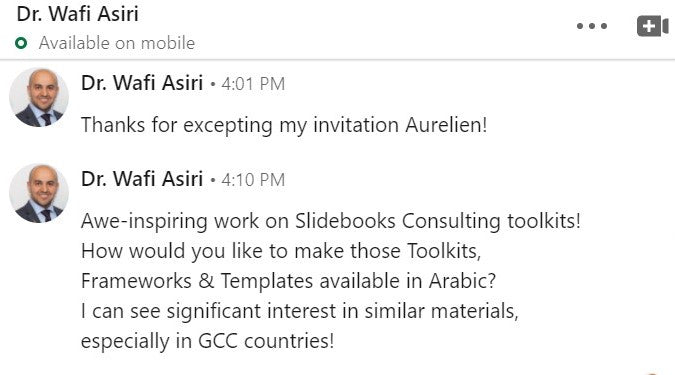

Awe-inspiring work on Domont Consulting toolkits!

Awesome. Thanks, I got a couple of packages and they are really great. I really appreciate you helping me learn this new path and work with your tools. So thankful for this resource as I ramp up things. Great job!

Management Consultant

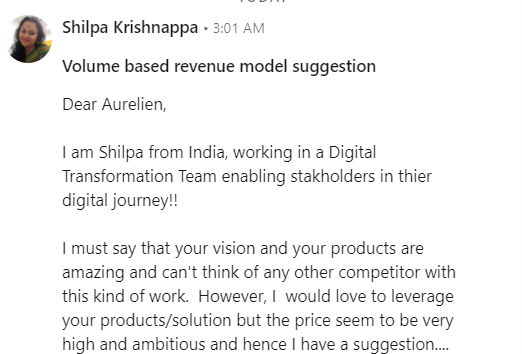

"You’ve done an absolutely amazing job in creating the toolkit for consultants. I requested for the sample version and loved it. The reason I am writing to you is share that while for Americas, and most of Europe, your price-points are great, for India, Philippines and other developing economies, USD 800 is what most consultants make in a month."

Independent Management Consultant

"Thank you so much for your service. I am glad I found your website! Truly useful! Though, it was not crystal clear on your website that the strategic plan template was part of the corporate & business strategy toolkit."

I would like to thank your wonderful consultants who took the time and effort to provide such an invaluable management consulting toolkit. It is amazing. I just need to make sure my download is complete, as there are a lot of material here. Kindly verify.

CEO

Great website Great website but I wish you had more frameworks, templates and tools around customer experience

CEO at Pic River Energy & Forestry

Excellent tools and great value as a senior manager. I'd love if you had also online videos and google slides instead of Powerpoint.

Consultant & Executive

"Wow, What can I say other than to thank you for the quality, definition and sheer volume of work provided. This is going to help me align our messages and save hundreds of hours (if not more) in preparation time. Will definitely recommend."

Deputy Director Group Ipesup

I hired Aurelien Domont and one of his consultants to help me value and sell our company to potential buyers. Very happy with their consulting services.

High quality and easy to use frameworks and templates. The fact that these were made and used by the top consultants in the industry says enough. Their customer service has been very responsive.

Aurelian provided effective advice for a business startup I was working with. His extensive knowledge and supplementary frameworks and document templates helped conceptualize and clarify what it was we were offering.

Excellent material. The content is good and powerful for structure

Entrepreneur and MBA student

I just finished my MBA and this product is fantastic. The quality of the graphics is of the highest level. It is an investment that will definitely be of great help to start my new business. The customer service is excellent. I highly recommend this Consulting Kit.

Consultant

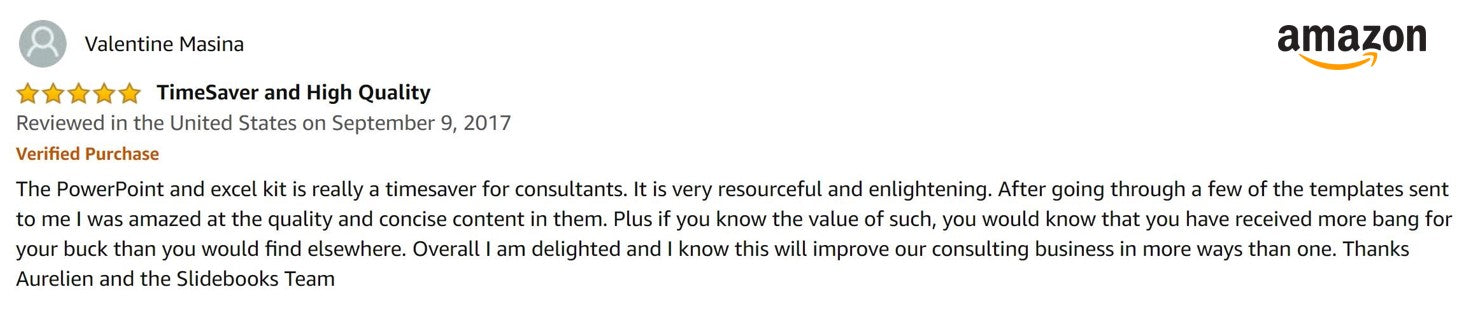

Really a timesaver for consultants. It is very resourceful and enlightening. I was amazed at the quality and concise content. Plus if you know the value of such, you would know that you have received more bang for your buck than you would find elsewhere. Overall I am delighted and I know this will improve our consulting business in more ways than one. Thanks Aurelien and the Domont Team

Even If I can't afford your hiring fees, I will rely upon your toolkits and templates to make sure that my perpectives are sound and on the good track. Thank you very much for sharing your hard work, providing high level expertize to startup founders like me, and helping create a cumulative economy.

Wondereful Toolkits. Will keep you guys in mind for other stuff. I had an issue with the watermark at the bottom of some slides. But they helped me easily remove it.

I purchased the gold business and consulting package this morning for my team of 3. Great content thank you!

The templates and the tools are very useful and insightful.

This is an excellent initiative. Thank you very much for sharing all these best practices!

Fully editable text, graphics, logos and colors

Instant download after purchase

Considered a refundable business expense

1-week money back guarantee (per terms)

Free support and advice from tier-one consultants

Guaranteed safe checkout

Get all our Toolkits for half the price with the Gold Access

Hire tier-1 Management Consultants (daily rate ranging from US $2,000 to $6,000)

Ex-Deloitte Consultant

15 years of experience

Ex-McKinsey Consultant

16 years of experience

Ex-Booz Allen Hamilton Consultant

15 years of experience

Ex-McKinsey Consultant

15 years of experience

Ex-Accenture & IBM Consultant

15 years of experience

Ex-Deloitte Consultant

20+ years of experience

Ex-Bain & Company

5+ years of experience

Ex-Ernst & Young Consultant

10 years of experience

Ex-Accenture Consultant

26 years of experience

Ex-Deloitte & EY Consultant

12 years of experience

Ex-PWC & Kurt Salmon Consultant

11 years of experience

Ex EY and PWC Consultant

19 years of experience

Ex-McKinsey Consultant

15 years of experience

Ex-Mckinsey Consultant

20 years of experience

Ex-Mckinsey Consultant

17 years of experience

Strategy

Helping a global automotive company increase market share by 15% over 2 years through a comprehensive market entry strategy in Asia.

Business Plan

Developing a 3-year business plan for a small tech startup, resulting in a 50% increase in revenue and a successful Series A funding round within 12 months.

Operating Model

Redesigning the operating model for a global pharmaceutical company, resulting in a 20% reduction in operational costs and a 30% increase in efficiency within 18 months.

Digital Transformation

Implementation of a digital transformation strategy for a small retail business, resulting in a 40% increase in online sales and a 25% reduction in operational costs within 12 months.

Mergers & Acquisitions

Facilitating the merger of two mid-sized tech companies, resulting in a 25% increase in market share and $50 million in cost synergies within 18 months.

Valuation

Conducting a valuation for a mid-sized manufacturing company, resulting in a 35% increase in perceived market value and securing $75 million in investment within 6 months.

Post Merger Integration

Helping the post-merger integration of two financial services firms, achieving $100 million in cost synergies and a 15% increase in combined revenue within 24 months.

HR and Talent Management

Implementing a new performance management system across a multinational technology company, resulting in a 20% increase in employee productivity.

Leadership Development

Defining and implementing a global mentoring program that cut employee turnover by 29% through mentorship.

Supply Chain

Helping a leading global fashion brand cut down on its manufacturing lead times by nearly 60% by improving its sales & operations planning.

Lean Six Sigma

Implementing a Lean Six Sigma project to reduce production cycle time by 25% and increase customer satisfaction by 15% for a manufacturing client.

Mergers & Acquisitions

Helping on the acquisition of a European fintech company by a global bank, resulting in a 20% increase in digital banking customers and $200 million in cost synergies within 12 months.